Trusted data

Access the data others wish they had

Get the industry’s deepest, broadest and most accurate data. Covering the whole energy transition supply chain.

Energy data and analytics solutions for an interconnected world — enhanced by AI and human intelligence

Break away from fragmented data to thrive in a complex world that demands an interconnected view of the entire energy and natural resources supply chain.

Explore connections between assets, technologies and industries, and the interplay across supply chains, government policies and global economies.

Understand connections between commodities and make confident investment decisions in a complex energy landscape.

Get the industry’s deepest, broadest and most accurate data. Covering the whole energy transition supply chain.

Add 2,600+ market experts, data scientists and thought leaders to your team – with direct access to senior analysts to guide your decisions.

Get the cross-commodity insights and valuation models you need to set your course in an increasingly complex world.

Get the industry’s deepest, broadest and most accurate data. Covering the whole energy transition supply chain.

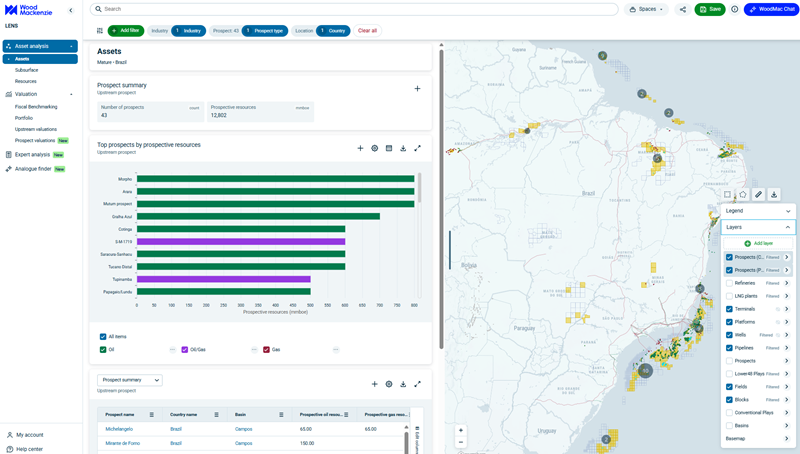

Lens Subsurface

Lens Metals & Mining

Commodity Trading Analytics

Power Trading Analytics

Supply Chain Analytics

Add 2,600+ market experts, data scientists and thought leaders to your team – with direct access to senior analysts to guide your decisions.

Get the cross-commodity insights and valuation models you need to set your course in an increasingly complex world.

Build and maintain resilient, sustainable portfolios through the discovery and development of advantaged resources. Lens Subsurface Modelling uniquely combines technical and commercial data with cutting-edge AI technology to enable you to make smarter, quicker decisions about capital allocation.

Data is changing so quickly… A product like Wood Mackenzie Lens allows you to visualise in real terms, a particular aspect you are interested in researching.

Loading...